Egypt's Credit Rating Raised to B Following Stronger 4.4% GDP Rebound

The upgrade by S&P comes with a stable outlook after stronger growth and fiscal performance.

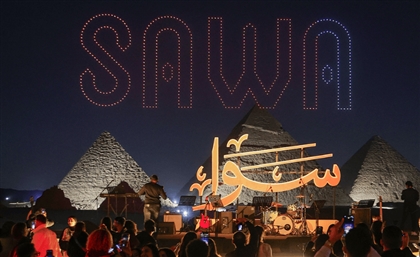

Eighteen months into a reform push that included a March, 2024 foreign exchange liberalisation, S&P Global Ratings have raised Egypt’s long-term sovereign credit rating to B from B-. The credit ratings agency kept the short-term rating at B, lifted the transfer and convertibility assessment to B from B-, and maintained a stable outlook, citing stronger growth and fiscal performance. S&P pointed to improved balance-of-payments trends alongside continued high government deficits and debt. Real GDP grew 4.4% in fiscal 2025, up from 2.4% in 2024, with reforms boosting tourism and inward remittances, and supporting external and fiscal metrics. Under the International Monetary Fund programme, measures have included fiscal consolidation, widening the tax base, rationalising subsidies and privatising state-owned companies, alongside a flexible exchange rate that S&P said improved external accounts and investor confidence. The government maintains a primary surplus of 3.5% of GDP in 2025, while debt-servicing costs remain elevated. Looking ahead, S&P expects real GDP growth to average 4.8% between 2026 and 2028, with tourism, inward remittances, construction, IT, domestic demand, retail trade, agriculture and healthcare likely to be key drivers. Ratings could improve if Egypt accelerates debt reduction, increases foreign direct investment and diversifies its economy, while a weaker reform commitment, higher interest costs or geopolitical shocks could trigger negative actions. S&P’s outlook remains stable.

- Previous Article UAE National Cycling Team Wins 17 Medals at Arab Championship

- Next Article Tabby Launches Saudi AI Factory With NVIDIA HGX Systems

Trending This Week

-

Feb 23, 2026