How Ejari is Disrupting the Real Estate Sector in Saudi Arabia

Ejari is a proptech startup that works directly with property managers to rent properties before re-renting them to tenants with a monthly payment plan.

Proptech startup Ejari wants to make it easy for people to rent homes in Saudi Arabia. With properties in the country requiring tenants to pay rent up front annually, the startup decided to introduce rent now, pay later services to provide residents with flexible payment options. Founded in 2022 by Yazeed Al Shamsi along with his team members Fahad Albedah, Mohammed Alkhelewy and Khalid Almunif, the startup works directly with property managers to rent properties before re-renting them to tenants with a monthly payment plan.

A second time entrepreneur, Al Shamsi came up with the idea of Ejari after experiencing firsthand the difficulties of paying a full year’s rent up front when he was a university student in the UK. Although he found a way to pay rent on a monthly basis, it wouldn’t be long before he would experience the same problem when returning to Saudi Arabia.

“After coming back to Saudi from the UK and Japan, I wanted to rent an apartment but had to pay 12 months upfront,” Yazeed Al Shamsi, Co-Founder and CEO of Ejari, tells StartupScene. “I couldn't afford it. I was a fresh graduate at the time. The problem came up again when I was looking for office rent for my previous startup. I realised that it’s a big problem that no one was solving, so I thought why not go solve it ourselves?”

To date, Ejari has financed up to $1 million in transactions since launching earlier this year, according to Al Shamsi. With demand for rental properties expected to increase as more people are moving to the Kingdom amid its growing economy, Ejari is looking to extend its services beyond rental homes to include industrial, retail and commercial sectors.

FINDING THE RIGHT BUSINESS MODEL

“We spent nine months to a year iterating our business model,” explains Al Shamsi. “We came up with seven or eight different business models and every time we would try it, we found that something simply wouldn’t work whether it was due to regulations or product-market fit, so we’d go back to the drawing board, and continue our conversations with the regulators and customers to find an alternative solution. We kept pivoting until we found the model that works best, which is the subleasing model that we launched last summer.”

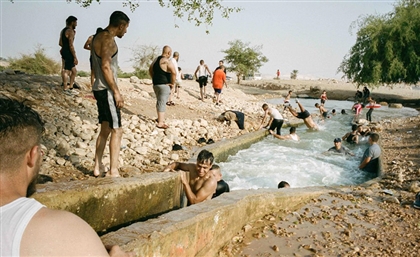

From a financing company to an insurance and peer-to-peer lending platform, the startup transitioned quickly from one business model to another until it landed on its rent now, pay later model. For the most part, this model has proven to be successful, especially since it can be challenging to get house loans in Saudi Arabia. “It’s difficult to get access to credit in Saudi Arabia, especially for expats, fresh graduates, and those in the 18-35 age category,” says Al Shamsi. “A bank finances you about 30% of your salary, but a lot of people’s rent makes up 40% or even 50% of their salary.”

Before paying the annual rental fee upfront, Ejari first screens customers to make sure they have good credit history. According to Shamsi, the startup’s acceptance ratio is less than 30%. Once a customer is accepted, Ejari then proceeds to make the payment, and then charges customers a company fee. “The way that we're doing it today is, you as a customer come to us and say I want this apartment, we go lease it from the landlord on your behalf,” he says. “We pay the landlord the required 12 months upfront payment and then sublease it to you with a monthly payment plan at a slightly higher price, creating a win-win situation for all parties involved.”

The startup takes about 15% of the total rent as its fee.

RISING DEMAND FOR SAUDI PROPERTIES

Demand for Saudi Arabia’s rental properties is expected to increase as the Kingdom continues to expand its non-oil economy.

According to a report by Coldwell Banker Richard Ellis (CBRE) on Saudi Arabia’s real estate market, average apartment prices increased in Riyadh, Dammam and Khobar by 10.7%, 1.8% and 2.0% respectively in the fourth quarter of 2023.

Recognizing this, the startup aims to accelerate its growth in Saudi Arabia with its latest pre-seed round of $1 million raised in October 2023. With real estate being one of the largest contributors to the country’s GDP, Shamsi sees a lot of opportunities in this sector. “I think we've barely scratched the surface, not just for us, but also for the market in general,” he says. “Last year in Saudi Arabia, proptech raised about $40 million, compared to close to $800 million for fintech, so there is still a lot of room for growth and a lot of opportunities for digitization within the sector.”

Besides property listings, which make up most of proptech startups in the region, Shamsi states that there is significant opportunity in property management, facilitation, and financing. That’s why he’s looking to expand his startup to not just focus on residential units, but also retail, commercial and industrial properties.

Looking to the future, the startup wants to build a superapp to provide everything from moving, furnishing, and facility maintenance to customers. “What we want to do down the line is offer a full circle of services that are going to help the renter in different ways,” he says. “So, we want to create a super app for the rental market, serving consumers along each part of their journey.”

Whatever the startup chooses to embark on next, its focus remains on making properties accessible to people. “What we're trying to do is lower the barrier of entry into the rental market,” he says. “It's about democratising access to real estate, helping people afford the most basic of needs.”

- Previous Article UNRWA Reports That 1 Million Palestinians Have Fled Rafah

- Next Article Kuwait’s Mamluki Lancet Mosque by Babnimnim Design Studio